Remembering the recession and housing crash, many are concerned that Northern Colorado’s housing market has marched upward for four years. Stories are common of homes selling in days or hours, with multiple offers above asking price. As the average home price in Fort Collins and Loveland has reached $400,000, is there a housing bubble?

Martin Shields, professor of economics and director of Colorado State University’s Regional Economics Institute is concerned about affordability, but said, “I don’t know if the market is over-inflated. There are plenty of people making plenty of money to afford to buy, but many people can’t afford to get into the housing market.”

He points out that the city is not building that many homes, land is getting scarce, and people continue to move to the area (net state in-migration in 2017 was 77,000, and is expected to be 61,000 in 2018, many bound for NOCO, the state demographer says), putting upward pressure on housing prices. He does not expect a major correction, and noted, “Banks have gotten more careful. Things are a lot different than the freewheeling mortgage days of the mid 2000s and ‘The Wolf of Wallstreet.’”

Brian Lewandowski, associate director of the Business Research Division at the University of Colorado Leeds School of Business says in his opinion there is no bubble. “It’s different now versus 2005-08, when more houses were being built than there were people to live in them. People lost jobs, couldn’t afford to pay the mortgage, and we saw the foreclosure crisis. Once the recession resolved a bit, strong net in-migration created demand for those homes. We solved that problem faster than it was addressed nationally, and growth and demand continue. Today, we’re not overbuilt.”

Eric Thompson of Windemere Real Estate echoes that, noting “First and foremost is new home construction. The last bubble was caused by over supply—too many homes being built. When there’s over supply, prices must come down. Today, we’re building 60 percent of the homes we were in 2004-05, despite a bigger population.” Metrostudy data says NOCO has had 4,452 new home starts in the last 12 months, 60 percent of the peak in early 2005.

“Over that same 12 months, there were 4,473 new home closings, indicating demand is keeping up with supply,” Thompson concluded.

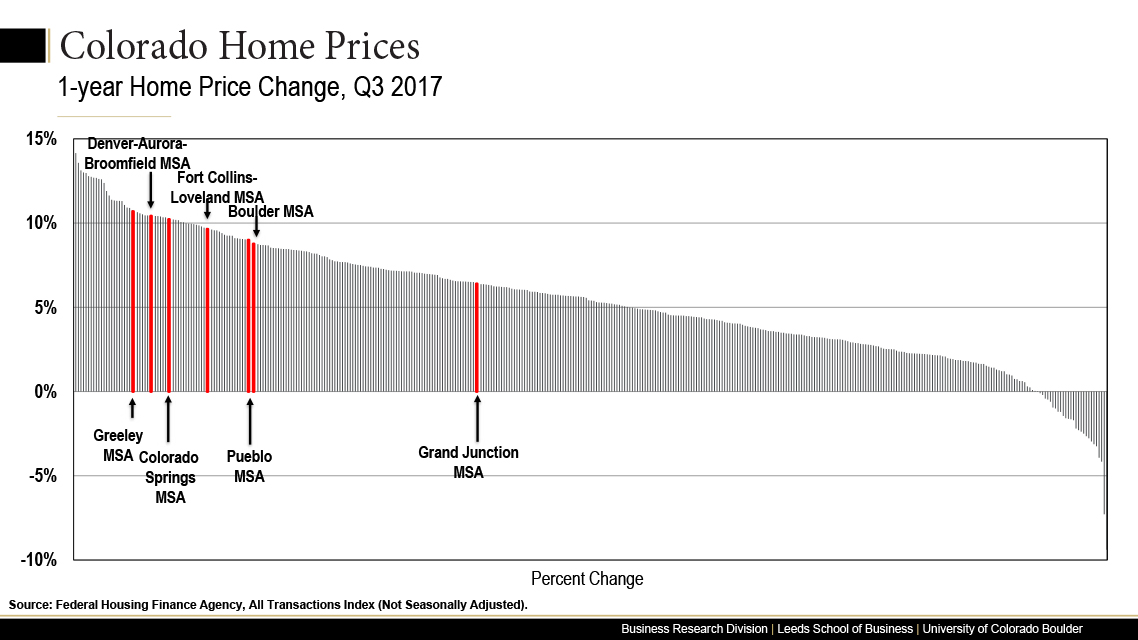

Ongoing demand and low inventory have created record high prices and rates of increase. That’s reflected in ATTOM Data Solutions’ ranking of Larimer County as one of the least affordable in the country in comparison to historic home prices here. Despite this, investors are active in Northern Colorado, with locals and non-locals, including individual buyers and organizations from Denver, Canada, China, and elsewhere actively acquiring investment properties. That speaks to the perceived value and opportunity that remains in the local market, and also makes things even more challenging for those trying to buy their first home or find an affordable place to rent.

Brad Shannon is an award-winning communications consultant and freelance writer based in Loveland. To comment on this article, send an email to letters@nocostyle.com.