Before going out to look at houses, Sears Real Estate broker Steve Baker handed a customer a list of 24 places.

“I want to see every one,” the customer said. “Not just your listings.”

Baker chucked darkly. “That is every one.”

Baker recalled the conversation a little more than a month ago during a discussion about Northern Colorado’s real estate market. In many ways, COVID-19 really didn’t change much, other than making things more inconvenient and possibly squeezing out newer agents. The problems, and that depends on which side you’re on, are the same as they’ve been the last couple of years. Inventory is low, so low, in fact, that sellers have a huge advantage, and prices continue to go up. And those are just the starting prices.

“Everything seemed to get multipleoffers,” Baker says. “You’ve got a buyer who wants to stay at $350,000, and you can’t find a whole lot out there, and when you do, there’s 10 offers on it, and they raise the price. In my 25 years, I’ve never seen inventory like this. It’s a battleground in some areas. Buyers use to be able to contemplate things. Now they have to really go for it.”

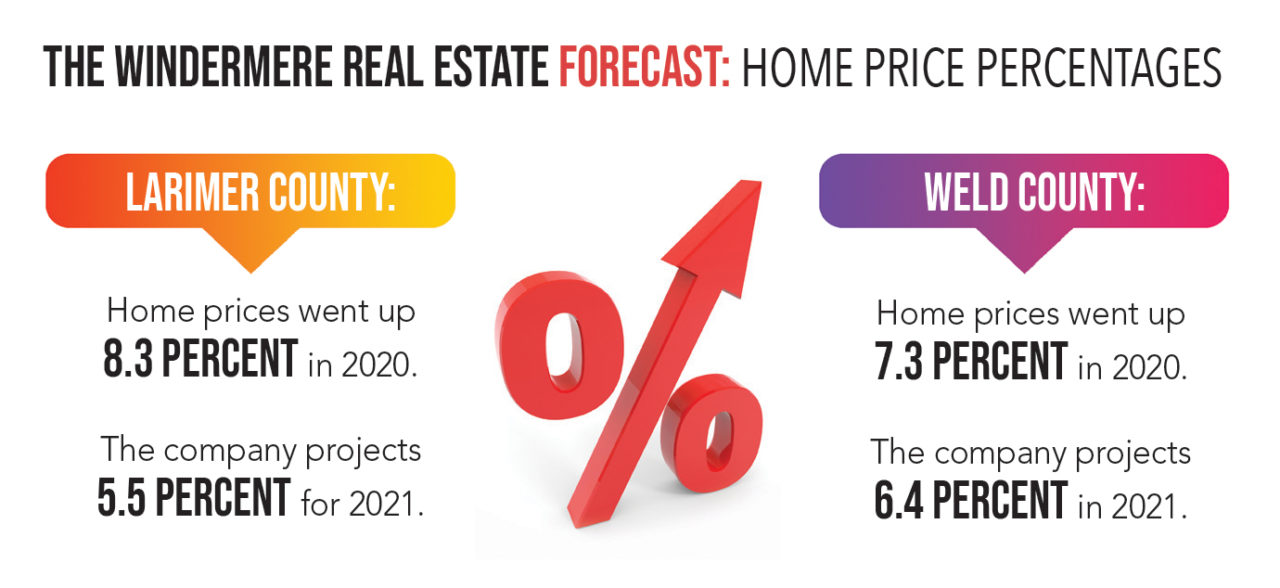

The problem isn’t much better nationwide, so it’s not just Colorado’s desirable lifestyle that’s selling homes, said Matthew Gardner, the chief economist for Windermere real estate, during his annual forecast. There were nearly 3.5 offers for every home sold across the country.

“We are woefully, woefully inadequate in supply,” Gardner says.

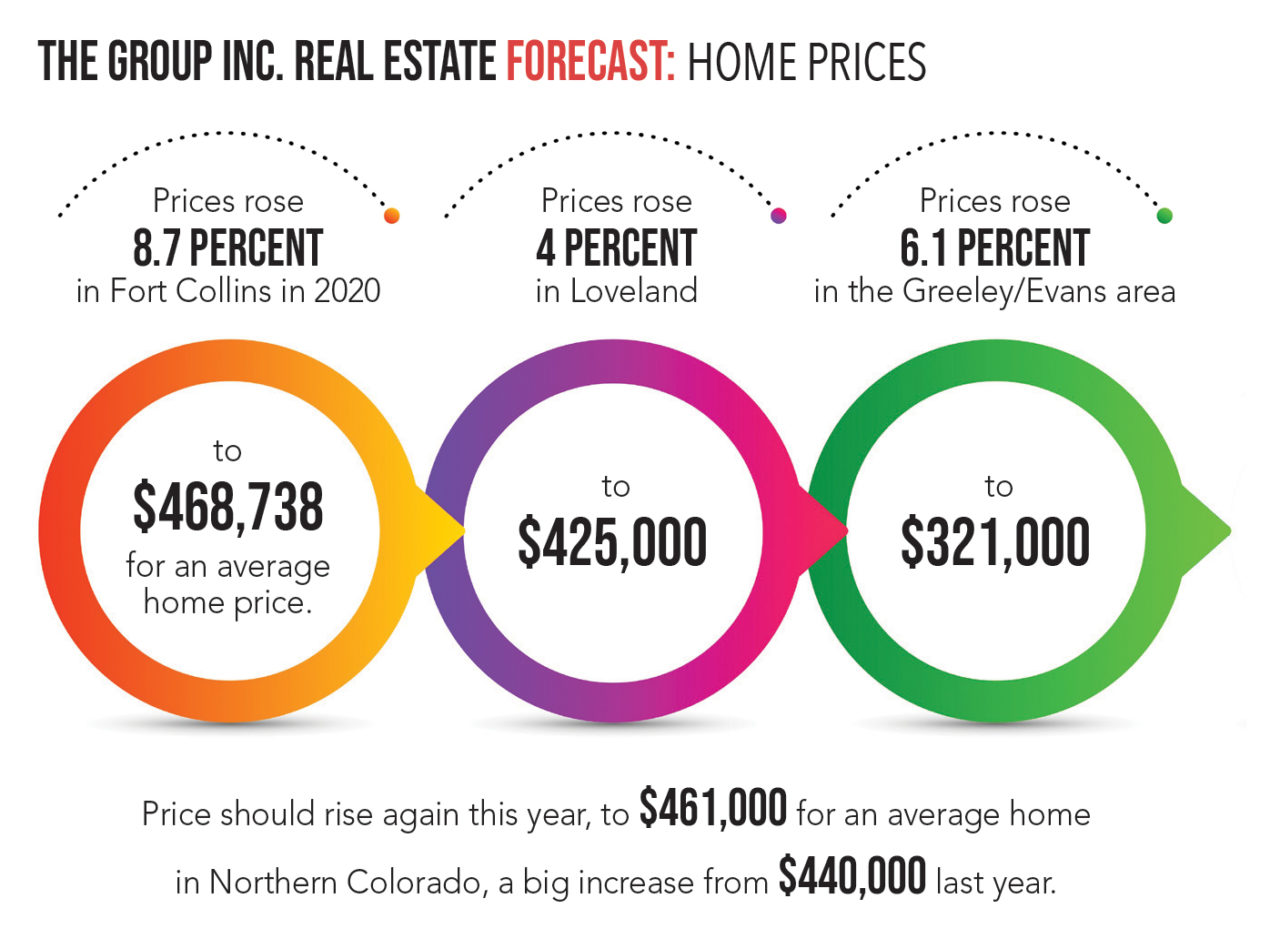

That, of course, affects prices. In 2020, prices rose 8.7 percent in Fort Collins, according to an analysis by The Group, which reflected the fact that there were 175 homes for sale in Fort Collins by the end of December in 2020, a 50 percent decrease from the 366 for sale in December 2019. Loveland also had less homes for sale this past December than in 2019, with a 45 percent decrease, and inventory fell in the Greeley/Evans area as well in December for a 42 percent decrease over 2019.

Mortgage rates dropped by a whole percentage point in one year, which drove up sales and kept prices high, but rates should go up this year, which will soften the market a bit. Some forecasts have rates as high as 3.3 percent, which is still low, but not nearly as low as they were historically, Gardner said.

Home prices are approaching rates where they just aren’t affordable in places such as Jefferson and Douglas counties, Gardner adds. Those prices, and the fact that income and salaries aren’t rising to meet them, will have to slow the escalation at some point, which would affect Northern Colorado as well. Prices more than doubled in value, almost tripled, in 2012 in Denver, Gardner says.

“I don’t know where else you could go to get that return,” Gardner says. “Maybe if you bought shares in Zoom before this year.”